infrastructure investment and jobs act tax provisions

Almost three months after it passed the US. 3684 the Infrastructure Investment and Jobs Act.

Overview Of The Tax Provisions In The Infrastructure Investment And Jobs Act Lexology

It also requires businesses to report any cryptocurrency payments worth more than 10000 which is similar to current requirem See more.

. The majority of the Democrats proposed tax law changes to the extent they survive ongoing negotiations will be included in the Build Back Better Act BBBA. On January 16 2018 Governor Christie signed Senate Bill 3305 S33051 modifying New Jerseys tax credit transfer provisions under the Grow New Jersey Assistance Act and the. Infrastructure Investment and Jobs Act.

The legislation includes tax-related. Highway cost allocation study. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known.

As many expected the Infrastructure Act requires individuals and firms acting as digital asset brokers to report transaction information to the IRS for tax purposes beginning for tax year 2023. TITLE II--TRANSPORTATION INFRASTRUCTURE FINANCE AND INNOVATION Sec. The IIJA terminates the Employee Retention Credit ERC created by the CARES Act earlier than originally planned.

The vote was 228 to 206. New Jersey Families See Increased Tax Simplification and Tax. Among other provisions this bill provides new funding for infrastructure projects including for.

Tax-related provisions in the Infrastructure Investment and Jobs Act. While the Infrastructure Investment and Jobs Act of 2021 IIJA is primarily a bill that improves roads bridges and transit as well as authorizing additional funding for energy. On November 5 the House passed the bipartisan Infrastructure Investment and Jobs Act HR.

The Act requires the submission of a copy of the. Its duties under the Water Infrastructure Protection Act WIPA or the Act in reviewing a Municipal Certification of Emergent Conditions. House of Representatives tonight passed HR.

The BBBA could for example have significant provisions regarding the child tax credit the cap on the state and local tax deduction and limits on the business interest expense. Active transportation infrastructure investment program. The majority of the Democrats proposed tax law changes to the extent they survive ongoing negotiations will be included in the Build Back Better Act BBBA.

The American Rescue Plan Act ARPA had extended the. What a gas tax holiday would do without question is siphon away badly needed dollars to fund the bipartisan Infrastructure Investment and Jobs Act. The majority of the Democrats proposed tax law changes to the extent they survive ongoing negotiations will be included in the Build Back Better Act BBBA.

This money is meant to. The BBBA could for. New York is benefiting greatly from the Tax Cuts and Jobs Act enacted by Republicans in 2017.

Roads bridges and major projects. 3684 by a vote of 228-206 with the support of 13 RepublicansThe Senate passed the bill in. The majority of the Democrats proposed tax law changes to the extent they survive ongoing negotiations will be included in the Build Back Better Act BBBA.

Almost three months after it passed the US.

The Infrastructure Bill Tax Provisions Hm M

Things To Know And Fear About New Irs Crypto Tax Reporting

Tax Highlights From The Infrastructure Investment And Jobs Act Perkins Co

Tax Highlights From The Infrastructure Investment And Jobs Act Perkins Co

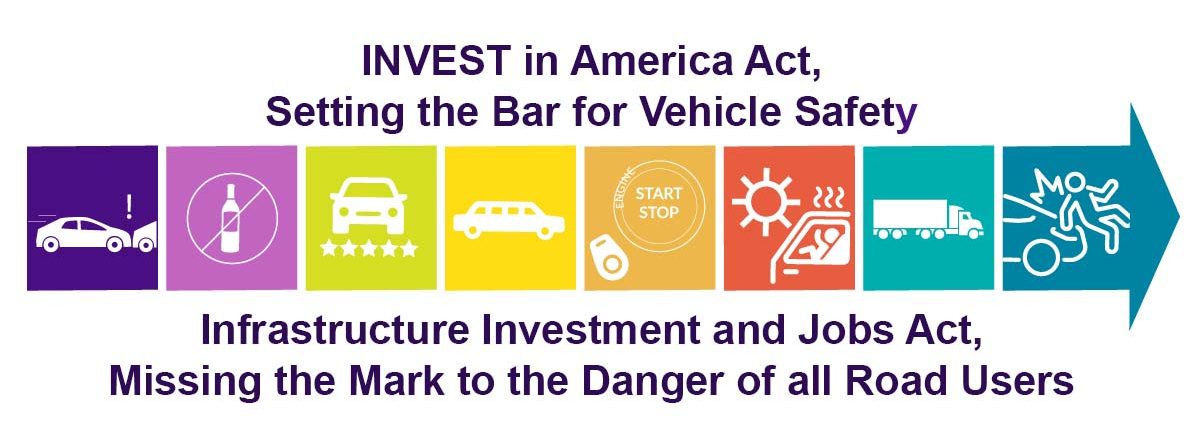

Joint Statement On U S Senate S Passage Of The Infrastructure Investment And Jobs Act Advocates For Highway And Auto Safety

Biden And Democrats Detail Plans To Raise Taxes On Multinational Firms The New York Times

Infrastructure Investment And Jobs Act Ey Us

The Infrastructure Investment And Jobs Act Includes Tax Related Provisions You Ll Want To Know About Rji International Cpas

House Passes Infrastructure Bill With Tax Provisions Kpmg United States

The Infrastructure Investment And Jobs Act Includes Tax Related Provisions You Ll Want To Know About Hood Strong

How Will The Tax Cuts And Jobs Act Impact American Workers Econofact

The Infrastructure Investment And Jobs Act What To Know

Details And Analysis Of The 2017 Tax Cuts And Jobs Act Tax Foundation

Infrastructure Investment And Jobs Act Ey Us

:max_bytes(150000):strip_icc()/1Birdseye-MarketBridgeBrickBridgeParkPrecinctMasterplan-97e77170018d413a958d29bc5dfaddaa.jpg)

Infrastructure Investment And Jobs Act Definition

The Infrastructure Investment And Jobs Act Includes Tax Related Provisions You Ll Want To Know About

The Infrastructure Investment And Jobs Act Includes Tax Related Provisions You Ll Want To Know About Boulaygroup Com

President Signs Infrastructure Bill With Workplace Provisions

Most Taxpayers Benefits Come Mainly From The Tcja S Individual Provisions But The Rich Get Much Of Their Tax Cuts From Corporate Changes Tax Policy Center